The Week Ahead

Volume 83 - Keep it slow and simple

"Some people grow into their dreams, instead of out of them."

Lois McMaster Bujold

Relatively inactive last week with only a handful of trades, the main one being the CL Feb14 72c, bought for ~2.7 and currently trading at 3.52. CPI was as expected and rates continue to price in 160bps of cuts.

Across asset classes, my view doesn’t differ much from last week. My preferred trade here is owning upside on the dollar.

FX

As much as the sell-side shilled FX value ideas and shunned carry in their 2024 outlook, so far, they were wrong. As I said last week - carry still exists and, therefore, still works. The writing is on the wall with USD/JPY +4% YTD. Sure, much of that is from yen underperformance due to participants expecting disappointment with BoJ policy, but I stick with owning USD upside, be that via JPY, EUR or other G10s.

I was talking to a subscriber this weekend who is on an FX vol desk, and we both agreed that owning EUR vol here is attractive. 1yr EUR vol screens cheap and is probably worth owning with the election. I do like buying downside via put-spreads 3m out.

Twitter - positioning tweet Positioning remains very similar to the attached tweet.

Like I said in the FX section last week, “Cable is still screening too rich, and expect 1.25 over the coming week/fortnight.” I will say that now you can expect 1.24 over the coming fortnight from here.

Single Stock, Index & Vol

Much of what I said last week remains the same stance for this week.

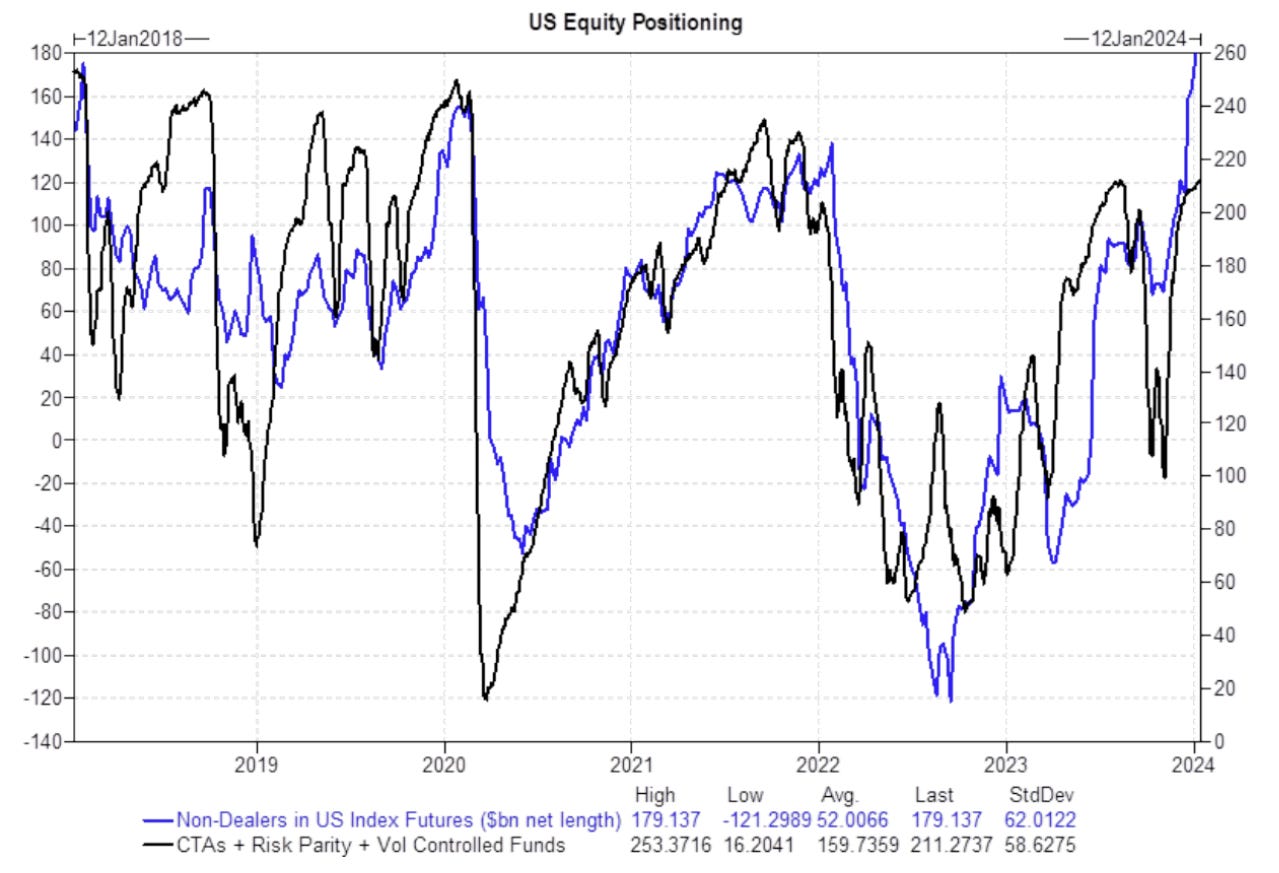

I like owning downside on index but further out expiries 3m/6m or do the Year Ahead trade where we sell a call spread to fund a put spread. Gamma has come off recently, but we need participants to buy more downside to push dealers short gamma. Nets are still quite low, so you need nets to come up a bit more for those participants to need downside for us to flush down. Logically, it would make a lot of sense for us to flush with guys not owning enough downside, but with nets so low, there isn’t much pain. But if you’re too comfortable up here being heavily net long… buy downside when you can, not when you need it.

One trade that I have mentioned several times for downside that is cheap is an IWM 185/175 bear put spread for March, which costs 1.6.

Now, what I expect for the week ahead…