The Week Ahead

Volume 47

Good morning America,

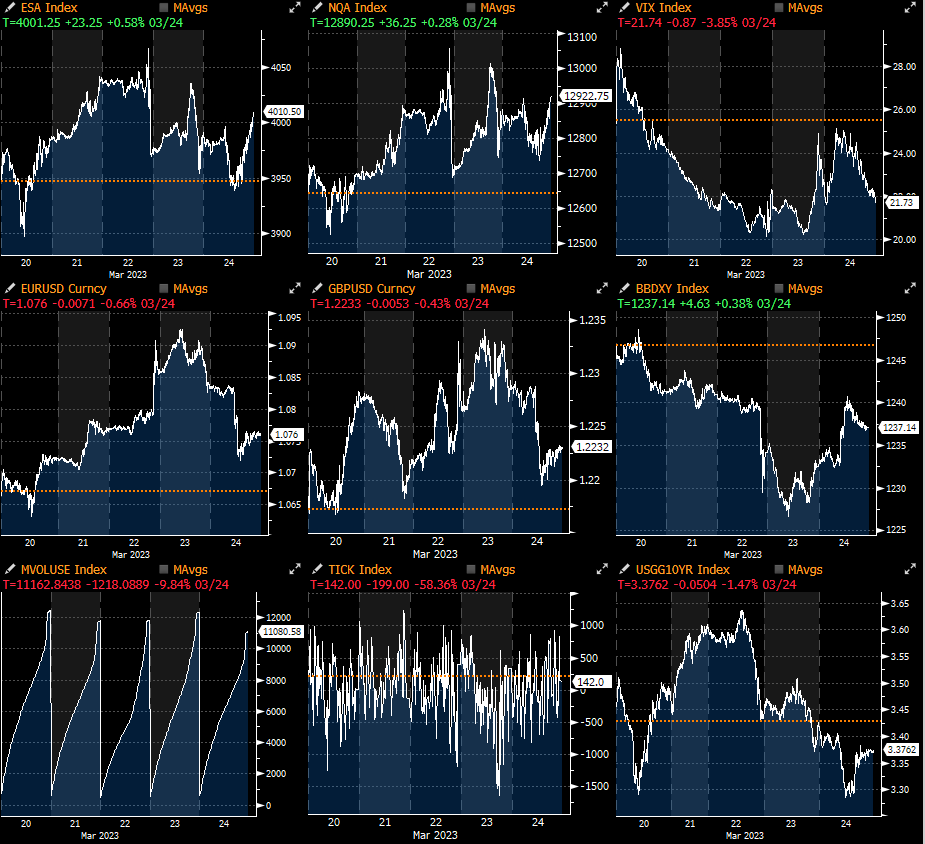

A strong week for stocks despite “the banking crisis”. I was wrong about the Fed decision, I expected a pause. On this subject… I think we probably saw the final hike of the tightening crusade unless the banking system has a serious problem.

A green week for me especially in the largest weightings of my book. Intraday trading was profitable but relatively light. A ten-bagger on Tuesday was a treat.

Interesting times to come as Q1 comes to an end. If 2023 could be defined by one aspect it would be frustration (or surprise).

Just an idea as it’s still close to the price I paid… Friday I bought an SPX 04/21 4100/4200 call spread for ~16. Now 22.5.

A fun fact from Goldman… “the MAGMA + NVDA cohort has added a collective ~$620bn of market cap since the regional bank issues began, which compares to ~$950bn of collective market cap lost by the remaining 494 companies in the S&P”.

QQQ vs DIA has been one of my best trades of the year - breadth has been poor and that makes me think of changing this trade up a little and opening short DIA vs QQQE.