Mid-Week Thoughts

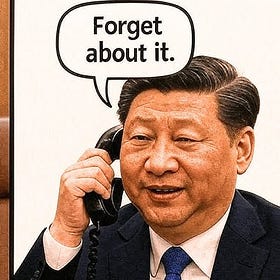

I was right, Trump's friends in Beijing really are imaginary

Nothing like a fresh set of headlines to highlight that the US administration's comments might not fully align with reality.

*CHINA MINISTRY OF COMMERCE: CHINA AND THE U.S. HAVE NOT HELD ANY TRADE DISCUSSIONS OR NEGOTIATIONS — ALL SUCH REPORTS ARE FALSE.

*IF THE U.S. REALLY WANTS TO MAKE A DEAL, THEY SHOULD DROP ALL UNILATERAL TARIFFS

*CHINA COMMERCE MINISTRY: ANY CONTENT ABOUT CHINA-US ECONOMIC AND TRADE NEGOTIATIONS IS 'GROUNDLESS AND HAS NO FACTUAL BASIS'

despite Trump this week claiming the following…

*TRUMP: GOING TO GET ALONG GREAT WITH CHINA, NO DOUBT

*TRUMP: US HAVING DIRECT CONTACT WITH CHINA DAILY

and saving the best till last…

*BESSENT: TRADE NEGOTIATIONS WITH CHINA "WILL BE A SLOG" (why? because they aren’t picking up the phone, Scott?)

*TRUMP: WE'RE GOING TO MAKE A LOT OF MONEY FOR OUR PEOPLE

Oh and also… *TRUMP: GOOD CHANCE OF RUSSIA, UKRAINE DEAL THIS WEEK

Anyway, now you know that all of the headline risk has quite literally not been real headlines and that it’s all one big attempt to smooth-talk markets, shall we dig in?

Reflecting on my Week Ahead post titled "Trump's Imaginary Friends in Beijing," it's clear that recent headlines coming from the US administration have added more noise to what are already markets full of uncertainty - or perhaps we could call it "fake news" from the US administration? Nevertheless, the underlying market directions and targets I highlighted still feel valid, even if timing adjustments are required. I believe that we remain on course for those predicted levels; just a little more patience might be needed than I had initially anticipated.

The Week Ahead

Markets rewarded conviction last week. My ES1 short, opened at 5473, is now trading over 250 points lower. Similarly, the gold call spread (GC 07/28), opened at $24, currently trades at $81 - I do plan to sell the spread this week. Both trades reflect precisely the environment I anticipated, risk aversion in equities driven by persistent (and growing) uncertainty. Both setups were shared in advance with paid subscribers. I talked about gold trading at $3,500 just last week!

And in case you missed it… I have attached my most recent Week Ahead post above.

Anyway… let’s recap, equities, particularly tech, have been resilient this week. That momentum, however, feels increasingly strained up here in the current range we are trading. While Mag7 might have been a bright spot this week, that might be short-lived depending on headlines (sadly headlines are more important than their coming earnings IMO). With rVol coming down, systematic selling from vol control naturally slows, and that will have helped markets take a small breather (alongside the market smooth-talking headlines from the WH).